mortgage interest rates graph explained for smarter decisions

Understanding the curve

A mortgage interest rates graph plots rate moves over time, turning scattered headlines into a coherent story. Notice slopes, plateaus, and sharp spikes: they often mirror shifts in inflation expectations, central bank policy paths, and risk appetite. Long, gentle climbs can signal tightening cycles; jagged reversals may reflect surprise data or liquidity squeezes.

Reading it quickly

Check the x-axis for dates and the y-axis for APR. Compare the main line with a rolling average to filter noise. If the graph includes points for 30-year fixed and ARMs, use spreads to gauge market stress. Watch the yield curve: when long rates drift below short rates, refinancing windows can open unexpectedly.

- Set a baseline: zoom 5–10 years to frame today’s level.

- Mark catalysts: CPI releases, Fed meetings, and jobs data.

- Track spreads: conforming vs jumbo, fixed vs ARM.

- Note volatility: big candles imply wider lock risk.

- Avoid overfitting: patterns break at regime changes.

Putting it to work

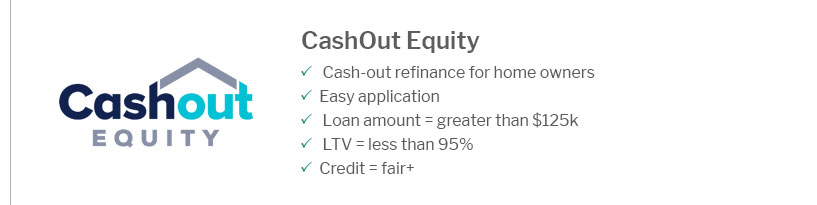

Use the graph to time lock decisions, test refinance thresholds, and stress-budget payments. Pair visuals with quotes from multiple lenders to confirm what the market will actually deliver.